Background, why and how?

- Steve Podmore

- May 2, 2019

- 3 min read

Updated: Sep 9, 2020

A Sustainable Innovation and Development Bank that could operate globally and would be suited to solve the most pressing of challenges - has been a long time coming.

The inspiration for it came 20 plus years ago - though the vision really became clear in late 2006. This is when the founder, Steve Podmore, started developing the first version of this business - then called Global Sustainability Challenge (learn more about V1 of the business here). Then the financial crisis happened...

Getting a new and bold venture funded at the best of times is never easy - but back then, these challenges were exacerbated. Systems of finance were failing the world and it was clear the social and environmental cost of this was just massive. But why was this the case?

While continuing working on the development of the original idea, seeking to understand what was going on, Steve proceeded to do a deep dive analysis of what was right and wrong with the financial world. As a relative outsider this meant looking at things with fresh eyes. This process included a great deal of reading, deep study and deep thinking, observation, conference attendance, and asking hard/dumb questions all the way through.

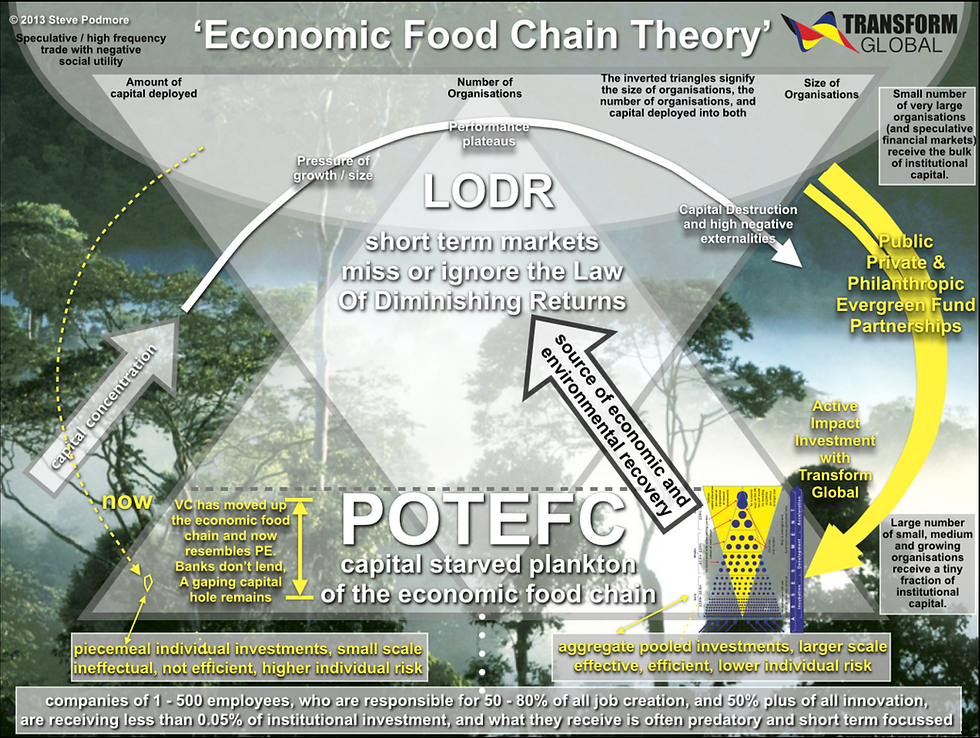

Steve concluded that for multiple reasons (including the internet, deregulation, policy mis-steps, poor governance by financial institutions, the advancement of financial technology and an increasing 'greed is good culture'), finance was increasingly flowing to big business, to ever faster financial trading and speculation of all kinds, and was doing so regardless of the often negative social or environmental impacts. In short, the system was incentivising the behaviour at every level that caused this capital concentration and resulting wealth transfer. At the same time, this created a vacuum, where finance was failing to flow efficiently to the parts of the economy (the real economy) that were proven as best positioned to deliver the scale of jobs and innovation the world needed.

The many realisations gained along the way enabled a concept to emerge that Steve called the Economic Food Chain Theory (which is now the basis of a forthcoming book, called Innovation Immunity). This macro economic and micro practical theory helps one gain an understanding of what was and still is going wrong with finance - and some of what is needed to to correct things. Importantly, to do so on a system level - to create the kind of future most want and deserve - and to address the most critical risk and resilience threats which loom over us all.

Back to the original plan and the post crash environment. It was clear that in line with core findings contained in the aforementioned theory, the plan needed to include the necessary innovations in finance to address the 'Access to Capital Challenge' to ensure that capital and organised help and support could flow more efficiently to the most important entities and parts of our economies globally - and could do so at necessary scale.

The founding motivation was to make a difference on social and environmental issues, and especially to tackle the extremes of inequity that were deemed to be so bad for the world. The belief was that this could be achieved by business as force for good, but that the businesses that were needed required a long term intelligent approach - which included how they were financed.

In addition to the sponsored competition that would help find young entrepreneurs with amazing sustainability ideas and introduce them to finance (version one of the business, called Global Sustainability Challenge), the plan was adapted to include funds packed with innovations that could actually invest into these capital starved entrepreneurs and do so much more efficiently and with the patient capital approach that was so important.

It was clear the key to this working was that the fund design needed to be fit for purpose - which meant being quite different to the venture capital style funds which were inappropriate for the type of impact ventures and projects that required funding. New innovative 'blended and extended' funds were designed and were to be raised by creating a sponsor supported Global Impact Investment Bank - which was initially named Transform Capital Management before being shortened to Transform Global.

Cutting a long story short, after circa 8 years, it had proven impossible to raise the funds to launch such a bold venture - and in Oct 2014 Steve came to the reluctant decision to put Transform Global on hold. This was in part to create a method of funding this bold vision independently, but also to tackle an underlying issue that was linked and very important.

Transform Global and other Big Impact Game-changers the world needed - required a way of ensuring they could be found, validated and supported - sufficiently so fairly and objectively if their ideas added up - they could raise the funds they needed to start, scale and deliver their intended impacts. At the same time, the public at large were increasingly feeling powerless and that the world was happening to them, and becoming more vocal and more desirous to impact the issues they cared about. The idea for BIGCrowd emerged and since 2014 the business model has been developed and refined.

Fast forward to early 2019. The realisation came that

Lessons of the founder and the many who have provided input - we believe will pay dividends for years to come.

Comments