The Economic Food Chain Theory

- Steve Podmore

- Apr 30, 2019

- 22 min read

Updated: Sep 9, 2020

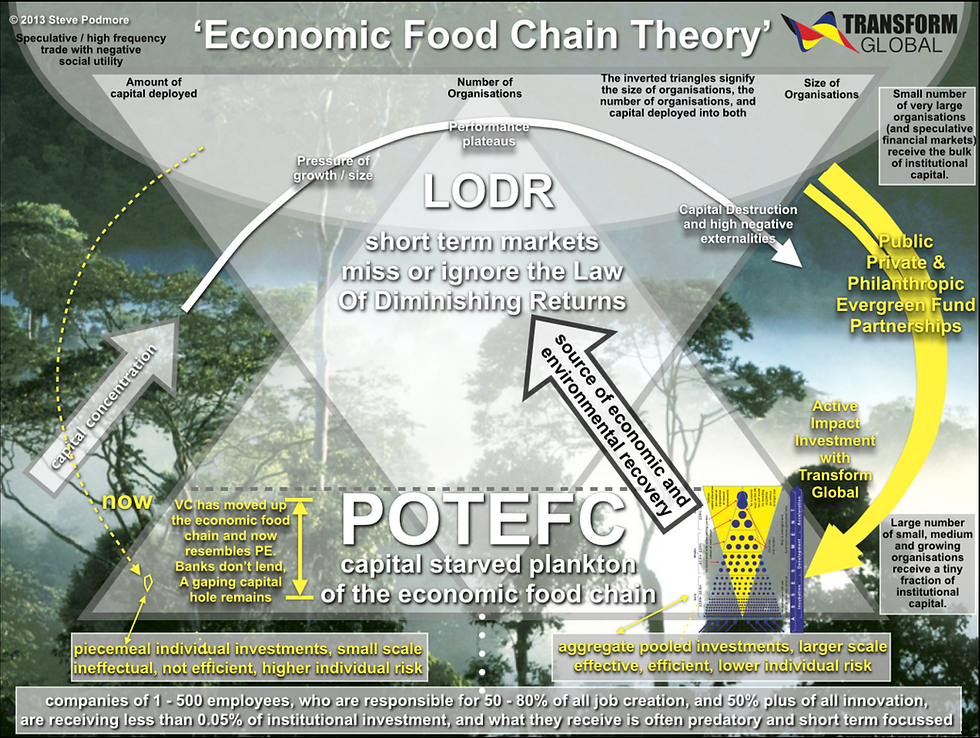

The 'Economic Food Chain Theory' is a macro and micro economic theory developed by Steve Podmore over the last few years. In a graphical and easy to understand way, it seeks to explain why our local and global economies are increasingly defying natural and absolute laws, and how this has contributed to serious economic, social and environmental challenges.

The above graphic needs a little time to fully understand but is relatively simple at its core. In the post below I will refer back to the graphic several times - further clarifying the theory .

With different characteristics but common regional themes the theory aims to explain and confirm where we need to focus attention to address the largest challenges of modern times. Since 2015 they can be viewed via the framework of the UNs 17 Sustainable Development Goals. The answer lies in making systemic changes how we utilise our financial, natural and human capital.

At its core, the theory takes a food chain in nature or the level of biodiversity that is prevalent when our environment is healthy - and it looks at our real world economies through the same lens. When any food chain becomes unnaturally unbalanced - often due to some external intervention or catastrophe - and this imbalance sustains over time, then the food chain is most at risk of collapse.

By examining where financial capital flows - and overlaying where jobs and innovation are shown to come from - one can see an inverse relationship (capital flows to areas which have historically created the least number of jobs and levels of innovation - and fails to flow to the parts of an economy which have been consistently shown to create the most jobs and the greatest share of innovation), and this creates systemic imbalance with serious consequences as described.

Looking into the detail of the capital concentration trends of our real world economies (visually alluded to in the above graphic), and viewing them in a food chain or biodiversity context, the picture becomes a great deal easier to understand. In short, with business as usual, the implications are dire for our increasingly imbalanced economic systems, with capital going to where empirical evidence indicates it is least efficient and even destructive in the broader social and environmental context. This imbalance is not just damaging from a social and environmental perspective - but is catastrophic economically too.

Nature can teach us some valuable lessons.

A natural system has balance. For example, a forest has big trees, little trees and everything in between. It also has the nutrients and biodiversity that ensures everything has the right food to grow, and the natural remedies, pesticides and waste disposal systems to keep it all disease free. There are natural cycles and nutrient level recycling at all levels, but it is all part of a living, dying, living, breathing - healthy system. It’s all connected, and the big trees of the forest cannot survive for long without the nutrient rich biodiversity at the bottom.

Yet, if one contrasts this with what we have in our real world economies, capital is flowing at ever faster rates and volumes to speculative financial markets and into both the good and the not so good larger organisations. If we want societies worth living in - the big questions I will attempt to answer are:

on balance, do the many public and private financial actors that fuel it all - serve themselves - extracting more value than they add, or are they serving society - adding more value than they extract;

if the former, why is this the case;

why do so many silos exist and how can they be connected and removed - and;

how can the behaviour we want and need be encouraged and incentivised, and the behaviour that is damaging to us all discouraged and disincentivised?

how can interests be collaboratively realigned and economies be reset and optimised to benefit the largest numbers of stakeholders, citizens and nature - and do so world wide and for the long term?

The law of diminishing returns.

As organisations increase in size, those who continue to do natural, thorough and diverse innovation - become fewer and fewer. While there are of course 'great' large organisations, scale gives challenges for most, which means as they grow, many organisations sweat assets and milk their cash-cows harder and harder. The late Clayton Christensen, the Harvard professor and noted author of ‘The Innovators Dilemma’ admitted as much, when at Davos 2013 he explained “for years he had been teaching executives of global corporations to do the wrong thing - hard wiring for efficiency innovation”.

The problem with efficiency innovation, is when cash cows runs dry, without meaningful and diverse innovation pipelines, organisations find themselves in a weak competitive position. The larger they become, the harder they find it to innovate with the smaller stuff, and like an oil tanker - they then struggle to change course.

Share buybacks disprove the claim 'we are amazing innovators'. Share buybacks are the canary in the coal mine signalling the inability to innovate the

The ‘small stuff’ is the kind of innovation (in the broad sense) can help these organisations find the ‘next big thing’, or indeed aggregate many opportunities to achieve the equivalent. Though on their own without sufficient traction, the multitude of small innovations that are largely invisible are falsely perceived not to ‘move the needle’ to give a sufficiently large potential impact on the bottom line.

It’s not that large organisations don’t innovate - the better ones of course do. It’s just that most don't do it sufficiently or thoroughly. It is almost like they are just skimming the surface of their innovation capability - and a number of barriers I call innovation immunities get in the way (Innovation Immunity will be discussed in separate posts and an upcoming book of the same name). To make up for challenges in doing diverse innovation, many tend to engage in a great deal more of the efficiency innovation that Christensen refers to - and this has financial engineering at its core.

The relentless pressure for short term returns rather than long term value creation (both in public and private markets) often results in larger corporations pushing any and all boundaries (or moral obligations and social contracts) to legally avoid the taxation that smaller or better governed organisations cannot or do not avoid. The short term competitive advantage artificially rigs the system - and thus tempts even well intended organisations to do the same.

Further - in the more negative form of capitalism (capitalism as it has become), jobs are said to be an inconvenience in the route to making money. Less responsible organisations thus strip out jobs if possible - deploying technology and ‘off shoring’ to do so. Many also ignore other critical externalities (economists speak for hidden costs) and while global corporations are powerful enough to do all this, governments are largely powerless to do anything about it. Governments even enable it, competing to lower or eliminate tax rates, often disadvantaging the citizens of the counties where in a fairer world,

So what we are saying - is that if open and diverse innovation could be properly embraced and funded, then organisations would not need to rely on exotic and extreme tax practices or working to strip out jobs to prop up their underperformance. They would be job creators and responsible tax contributors in a win win for all. They and their investors could indeed do good and do well.

If all corporations were responsible and ethical, and did all they could to understand and avoid hidden costs to others - it would not be so bad. Sadly that is rarely the case - and with some exceptions, plummeting levels of trust in global corporations reflect this.

Investor enablement.

If different classes of investor into global corporations and various funding mechanisms and structures that finance them, also had effective and responsible governance, the picture would also look a whole lot different. However, the hypothesis contained within the broader economic food chain theory, details an inverse relationship between the percentages, speed and volume of securities traded in corporations - and the level and effectiveness of governance.

Transient ownership creates the conditions for absentee governance - with long term risks taken less and less into account. These are the same risks that organisations with negative externalities are increasingly exposed to. Short term market behaviour is bad from a sustainability angle, and therefore from a macro risk perspective too.

A market that is short term will inherently favour organisations that ignore their externalities. Large organisations and their investors that ignore these costs will make more money in the short term. Thus they will be worth more, becoming even more powerful in the process - until they become seriously unstable.

The future is now

There is now a growing number of great organisations that are green, sustainable and their returns outperform their brown equivalents over time. In a resource constrained world, with a growing population, they are the future.

Paraphrasing J Edwards Deming, the famed American quality expert who was initially shunned at home but embraced in his adoptive Japan “quality will always cost less over time, and will deliver more, but in the short term it requires thinking, hard work and investment”. The same is true for sustainability.

Without doubt, being responsible and factoring in hidden costs (internalising externalities) will deliver more over time, but in the short term, additional investment is essential. It’s also harder to do and is especially so without methods of doing and funding diverse innovation. Funding the diverse innovation is the key, and even with the growing trend in ‘open innovation’ it just doesn't register on the radar of most larger corporations. With the positive financial innovations, collaboration models, consumer sentiment - and important public policy developments that are fast emerging, organisations that suck value out of the system rather than contribute to it - must adapt or die.

While the kind of innovation, development and economic roll out activity we need does lie hidden within some larger organisations, as history has proven time over time, those that are ignored and least expected - will be those who deliver innovations the world needs. We just have to make it easier for them to emerge - and the future can be a lot closer than many imagine it can be. More on how we propose this can be done later.

Perverse incentives layered (or lawyered up) on top of perverse incentives.

Then we look at the financial services industry itself, and look at the motivations, activities and tools available to the actors on the stage.

If one gets to the heart of the incentive for the legions of lawyers, accountants, traders, actuaries and assorted consultants, pension funds and other institutional investors, investment banks and other intermediaries, and the many suppliers of technology and support services (as one can also see in the graphic), the whole system automatically seeks larger deals, faster trades, liquid investments and high returns (always with the desire for ever lower risk). We call this ‘speed and weight of capital creep’ and as we will explain a few paragraphs further on, it is enabled by a system that over time has ‘removed the bulkheads’ from the ship.

Back to today. With all the pressure of a competitive and testosterone fuelled system, where ‘only the paranoid survive’ - capital is directly or indirectly forced into a smaller relative number of larger corporations - via private or public placements, or traded debt or equities (for this discussion we will ignore the effects of trading in currencies, commodities and real estate).

Some of these organisations, because of the system pressure to do M&A activity, a relative lack of R&D as described, and the absence of thorough innovation as discussed - are increasingly weak. Partly because there is so little diverse capital formation at the base and successive middle layers of an economy (covered later), capital in the system therefore has less tangible opportunities at the top to invest in, and therefore a greater share of it ‘concentrates’ into traded activity.

The share of capital that is directly or indirectly allocated into ‘high frequency trade’, for example - increases year on year. Yet it can be argued - financial instruments - traded by computers multiple times a second, are sucking up capital that could be used productively elsewhere - and rather than adding value to the system, these algorithmic arbitrage trading functions are extracting it. Again we’re not saying all financial trading and speculation is bad. Rather - it’s when it's done to the extreme and to the expense of the real economy - that problems occur.

Collective Stupidity v Collective Intelligence.

Causes of capital concentration include deregulation, globalisation, the internet, and many questionable and hard to regulate financial innovations. It is all obscured by ever greater complexity which even insiders or so called ‘financial professionals’ find hard to understand.

When you take a 360 degree look at the financial system however, digging into detail as appropriate, and then going back to the umbrella view - providing you look with an open mind - it’s not too hard to unpack. While many actions make sense for individual organisations, it all adds up to a collective stupidity. The solutions though lie in the harnessing of collective intelligence.

Just imagine a ship with the bulkheads removed (for example, to use less material). In a stormy sea, however, if there are any points of vulnerability where the water can get in. When it does - all the water can quickly slosh to one end and the concentrated weight, critically destabilises the ship. If this was just one ship, losing one vessel would still be awful but would not present systemic risk. Though if all ships removed or were designed without bulkheads this would present an ongoing danger of catastrophe and a high probability many would lose their lives with knock on effects including on confidence. In a way, this is what has occurred on a macro economic level.

In our real world economies - and as the top graphic also indicates, rather than sloshing to one end, financial capital concentrates upwards into a relatively small number of larger organisations, or as we have already said, into the metaphorical bubble of speculative trade.

While we use the nautical example of removing the bulkheads from the ship, the food chain example from the natural world - would be chopping down trees on a hillside, causing erosion, destroying the soil, and leading to floods, famine or in certain geographies - desertification.

There are many ways to look at this big complex system, but the lesson is that our financial systems need the diverse fabric and natural barriers for protection - just like nature or great engineering. This cannot be achieved by regulation alone, nor by existing structures - but by a healthy dose of responsible competition, well funded systemic innovation - and the focus on intelligent and well designed governance - all baked into the delivery organisations through leadership and culture.

What would intelligent economists focus on?

What many economists seemingly fail to understand is that capital concentration away from the real economy and away from economic diversity - is the greatest threat to economic, social and environmental health.

These imbalances cannot be addressed with simple policy interventions alone, either fiscal or monetary - though clearly policy support of all kinds can help - or it can get in the way. Nor can these challenges of imbalance be sufficiently addressed by existing actors (such as banks, development finance institutions, seed investors, crowd funding and venture capital style funds), certainly at a scale to make a meaningful difference. These existing actors have the practices and culture that has failed to solve these issues so far - so why would one think that they would solve them now. They won't - though the better ones will still have an incredibly important roll to play.

The focus needs to shift to enabling, finding, funding and supporting the system innovators and big impact game-changers. There are many intelligent structures, proposals and innovations that are fit for scaling. These are both new, and existing structures that could scale. Though often, these are the ones that need significant and patient risk capital and support, so they can break through the barriers typically faced by the kind of system innovators we so desperately require.

They include those with innovative policy interventions that have the ability to scale or be replicated, or work alongside new fund structures or platforms. Also there are those who have devised new patient capital and blended fund structures, banking models to support them, and platforms designed to deploy capital a great deal more liberally - but in ways that can work for investors and other stakeholders also. Where the design and structure can work in ways that are both fair and responsible for those who require the capital, whilst also giving the flexibility to innovate and also embed the long term approach, incentives and culture that such system innovation needs.

Preference should be given to those who have new ways of capacity building and delivering investment readiness for the later stake investors who currently lack sufficient volume of quality deal flow for all kinds of infrastructure, enterprise and commercial activity.

In addition, the activists, NGO's and consumer groups who are working to devise and stimulate the fair future of finance, working for good actors and against those that are consistently shown to be bad - they need funding and support too.

In summary, should we be able to find1000 potential financial system innovators with bold plans and incredible potential, and fund them and support them properly, then perhaps 10 - 100 will emerge with the collective potential to scale and potentially change the world.

Embracing innovation and debunking accepted myths which relatively simple maths can disprove for those with an open mind.

Extending the concept of what economists should focus on, basically we need more of what is economically, socially and environmentally useful - and less of what isn't.

Of course, deciding what is and what isn't is not an easy task, but that doesn't mean it should be avoided. While a great deal of work has gone into methods of targeting and measuring impact, much more needs to be done. The Responsible Investment, Triple Bottom Line, ESG and Impact sectors and related movements have indeed made progress. The UN via its UNEPFI PRI (United Nations Environment Program - Financial Initiative - Principles for Responsible Investment) now has signatories who are responsible for $90 Trillion of institutional AUM (Assets Under Management).

Signing up to a set of principals however is a long way off actually getting capital to where it is needed and just as importantly, turning the spigot off for where it is socially or environmentally destructive. However amazing, in the context of the massive need - these initiatives are just a scratch on the surface of what needs to be done to create economies worth having and living in and doing so around the world.

Many prominent actors such as Stanley Fink of Blackrock in his annual letters and media appearances talk of blended value, enhancing ESG (Environmental and Social Governance), and of the need for economic diversity. There are many others who talk about the importance of democratisation of capital and the need for new models of investment - but they lack the methods and proposals of how they can practically be brought to bear. Often these same people have many layers of protection that makes them completely inaccessible to those with the ideas they are searching for - and the middle men (and sometimes women) get in the way - with different agendas and risk aversion. They or their principal as a result pay short shrift to those with proposals and models that could deliver, rarely spending more than a few mins before quickly dismissing them. As so often is the case - it is a nano second of attention and minimal resource spent to asses those solutions to the worlds most pressing challenges - which could be sound, even if they are not yet demonstrated or communicated as such. It is important to understand that they cannot be without strong operational teams and sufficient funding, skills and support. This chicken and egg challenge is at the heart of what economist, policy majors and concerned asset managers need to get their heads around. Their failure to do so has ensured that these massive economic imbalances still remain - weakening society, not producing jobs and not protecting and nurturing the natural resources we all rely on for life.

I contend that this because few understand the real economic dynamics and the importance and necessary cost of investing at these layers of an economy (dynamics = 'forces acting upon matter to produce or alter motion'). Nor do they understand, the silos and market inefficiencies mean the cost of solving these issues could be far less and more value adding than perpetuating the status quo.

As already described, the blind spots are in the areas of capital formation and democratisation, capacity building to enable it. These include; implemented, adapted or new policy and legal frameworks; institutions; funds and fund structures; (to effectively intermediate) and also into methods of building the technology and talent base that can build this new financial world with a culture that takes the best bits from the old, adds the new, integrates, innovates - and does so with the long term, fair, responsible but still commercial and competitive approach.

But diverting capital from where it is destructive at worst and neutral at best, to where it is more productive - means there has got to be somewhere it can go to. Someone, some group or some sector - has to own the responsibility of filling thee funding gaps and widening investment bottlenecks. Not as is the case currently - a pass the book mentality. While there needs to be ownership, there needs also be a way to connect or remove silos and silo thinking - and most importantly, to find, give a fair hearing to, capital to those one might not yet understand or perhaps that many might even disagree with - and all the help support, publicity and fair governance - that they need to stand a fair chance of achieving impact, success and commensurate returns.

Things are changing though they are not changing anywhere near fast enough. The Covid-19 Pandemic is causing many people to open their minds, refresh their thinking and even examine new approaches to economics. However they are doing so with the backdrop of economic shocks and hardships seemingly coming out of nowhere at a rate not seen since the great crash of 1929. However, the planet now has a further 5.8 Billion people living on it.

On average - financial trading strategies simply cannot outperform the inherent value created in an economy. In other words, finance has become a zero sum game. I win, you lose - rather than, grow the economy in a way that is intelligent to society and nature - and we can all win.

Financial trading should be a facilitator of real world trade, not a replacement for it - and when the trading happens to extremes it’s time to get worried (take a look at the financial service industry rising relative contribution to tax revenue as a barometer for this).

So if an economy is getting weaker, where consumers cannot consume because their cost of living rises but where wages stay the same or drop; or if consumption is fuelled by debt and not by productive value added or exchanged; and if energy costs more to harness or transport, and clean up costs or consequences increase (fossil fuels / climate change etc); or if less jobs are created in an economy than are lost - then all the trading activity is just dividing up the spoils of an ever smaller pie (a pie that appears much larger).

The real risk and resilience threats.

The Economic Food Chain Theory perspective - is that the capital concentration so described creates a perfect macro economic storm. Governments have more costs, more dependents and less cash to pay them all.

Furthermore, with so many of the players in the financial system profiting from what amounts to the collective stupidity described, the markets miss the aforementioned, truly important and absolute law of diminishing returns. As Upton Sinclair said and Al Gore quoted - “It is difficult to get someone to understand something, when their salary depends on not understanding it.”

With all actors in the economic system allowing capital concentration, and not working to thoroughly reinvent finance at the other end of the spectrum, we have done the equivalent of cutting off the oxygen supply (financial capital) to what we call ‘The Plankton of The Economic Food Chain’ (Infrastructure / SME’s / start-ups etc).

As a result of the drivers explained above, early stage investment, which is widely understood to be the lifeblood of our economies, is fully ignored by most institutional investors! It’s a hassle - not an essential.

If one looks at the numbers, of the institutional capital pool, only about 0.05% - 0.5%, ($1 in $2000 - $1 in $200) (source - derived from IMF asset allocation report and related material) is invested into the part of the market that in a developed world country like the UK or the US, is widely accepted to be responsible for 60% + of all innovation (source - from UK perspective - Respublica). Yet - reinforcing the earlier comment, and as shown by recent news, a great many corporations do everything possible to ensure they pay the minimum in taxation, and often hold unproductive capital offshore as a result.

On the other hand, small but growing companies at the bottom of the economic food chain pay proportionally more tax to support public services and society at large.

The type of dynamic, lean and profitable organisations where innovation is rife spring from anywhere and include people with an idea, kids in college, start-ups, to medium organisations of 250 employees or more.

They are also known to be home to, and creation engine of the largest number of jobs (50% + in the emerged markets - up 80% or more in emerging markets (source - International Labour Organisation).

The numbers and nature of innovation can be debated for a long time and we are not saying no innovation comes from large organisations. Of course it does, and scale is sometimes a very good thing. But the nature of large organisations - is the majority slow down and stifle critical innovation more often than not.

For example, it was Microsoft that commercialised DOS and Windows - not IBM. Google created and monetised search in a sleek way that resonated with the world - not Microsoft. Facebook worked out how to do social networks - not Google. And Amazon worked out how to sell a huge offering of books in physical and Kindle format - not Borders or Waterstones. The list goes on.

However great an organisation might be, staying great, lean and innovative through the stages of growth is the greatest challenge of all.

Knowing this, once they have it, many will do everything possible to reinforce their power and monopoly. When they do however, arrogance and disfunction quickly follow. Shortly behind are significant strategic missteps, which for large or global corporations, can be fatal. When they are - significant shareholder (e.g. pensioner) wealth disappears in a puff of smoke - but what is lost is often obscured by a fog of financial engineering.

The point is, aside from whether it adds or subtracts value on a societal level, capital deployed at the top of the economic pyramid, in huge quantities can be lost in the blink of an eye - yet no-one bats an eyelid.

However at the other end of the scale - gaining access to capital is like getting blood from a stone, and capital that can be raised routinely comes from disjointed sources, and is invested in ways that contributes to failure rather than nurturing and enabling success.

Now lets get a contextual reset. Even if the part of the market that is currently ignored by the financial world only came up with 40% or even 20% of innovation, and created only a similar number of new jobs, does it really warrant putting in less than 1%, (or even less than 5%) of all institutional capital?

How many more jobs would be created, and solutions generated for important social and environmental issues, if bottlenecks could be removed to unlock capital and support in the famed ‘Valley of Death’, and other key risk areas - and do so at adequate scale?

The inverse relationship between levels of capital invested, versus sources of job creation and innovation, is a global phenomenon with serious consequences.

So in food chain or biodiversity terms - we have tried to survive off economies that have more than their fair share of big tree equivalents, and we have failed to see the enormous value the rest of the vegetation and biodiversity delivers (innovative, high growth and diverse real economy SME’s, and everything else).

The most important innovation society needs, is in the forms of finance which can unlock a vibrant mix of positive economic activity, and at a much faster rate.

A key problem that has so far prevented this, is the perception of risk in early stage investing is high - and the lure of short term ‘established market’ investing gets ever higher. There are powerful sales and marketing and inertia forces at work. This further compounds the problem of imbalanced capital flow and reinforces negative perceptions held by institutions of investing at the earliest stages - and has stalled the kinds of financial innovation we badly need.

A big part of why capital does not flow more effectively to where it is needed for healthy economies - is due to how funds are structured and raised. This leads to challenges in how these funds are invested.

Generally, funds for investing in areas which are viewed as risky, or into entities which are small and require aggregation (such as those required to create jobs, feed a growing population, and provide water and clean energy for all), where more work is required for success, are 100% equity - or risk money. Often this capital comes from investors who seek to maximise financial return, and funds are mostly structured to last 10 years.

For many reasons, these funds are incredibly inefficient, but remarkably this basic fund structure (the 100% equity - 2 : 20 - 10 year model - commonly used in VC or PE) has seen little innovation in 40 years.

In this out of date structure, with typically one class of investor, returns sought to compensate for the real or perceived additional risk, actually prevent the funds investing into the type of enterprise that most require capital. Ironically these are where decent aggregate returns could be found if a little more thought was given to the structure and system of investing (the many related inefficiencies in how capital is raised and deployed - will be explained in the forthcoming book).

As a result of falling early stage venture or similar performance, and with pressure from institutions, in a weak attempt to reinvent and de-risk, the early stage funds that do exist have become smaller, more narrowly focussed, and increasingly invested into digital only opportunities. But this is a damaging false economy.

High return expectations, means decent help and support alongside investment is just not possible, and funds rarely posses critical mass which in turn would enable better systems and efficient investment portfolios. Worldwide, there are very few funds that at scale, provide angel and seed money on fair terms along with the necessary help and support these young companies and their founding entrepreneurs so often need. Nor are there connected funds to provide the follow-on capital they then need to succeed (assuming there is not a liquid and vibrant investment market to provide it instead). So virtually no institutional money goes to the very earliest stage. This is the case in mature markets - and it is much worse in the rest of the world.

There are innovations such as crowd funding and peer to peer lending, and even barter platforms springing up, but they are still nascent industries and are a relative scratch on the surface of what is needed. Peer to peer and crowd-funding is also direct from the individual, when the point should be, institutions that hold capital (asset owners), on behalf of the individual should be placing that capital more effectively into the real economy where most productive value could be added.

Also - direct from individual investments however they are facilitated are not suitable for larger investments or infrastructure - where there are significant funding gaps around the world. Tackling capacity building or risk capital - and filling these gaps is of upmost importance.

When governments try and fill these gaps, the institutions they create, and the direct and indirect stimulus packages, are often blunt instruments. Unwieldy, disjointed and not fit for purpose.

However, the key to addressing these challenges, is figuring out how to help governments, who do have a role to play, connect more effectively with institutional investors, philanthropists and other key actors, ironically including, motivated - innovation seeking corporations!

Put simply, less investment (and less intelligent investment) at the bottom of The Economic Food Chain, means less and lower quality of organisations and returns at the top. For the environment and society as a whole, with a growing population in a resource constrained world - we are currently going in the wrong direction.

Underutilising our Human Capital, over-utilising our Natural Capital, and with an elite few at the controls of a complex system - misappropriating or misdirecting our Financial Capital as a primary cause.

So in summary - if you only support and feed the largest of your dominant predators (monopolists), and you cut off the oxygen supply or suppress the conditions in which the plankton and smaller fish can thrive, then it is only a matter of time before the big fish go hungry. However If the food chain is re-balanced, everything works. Each part of the chain relies on the other, and the food chain can strengthen and self correct over time.

Comments